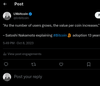

Time, Money, and the Limits of Scale

When money escapes human scale, value becomes distorted, Bitcoin restores fairness by anchoring wealth to finite time, not infinite debt.

Humans are bad at scale. Not “a little bad”, catastrophically bad.

Our brains evolved to understand minutes, days, seasons, maybe a lifetime. Once numbers get big enough, they stop feeling real and turn into abstract noise. That’s why trillion-dollar headlines barely register anymore. They don’t feel dangerous. They don’t feel heavy.

But time exposes the lie.

Seconds Don’t Lie

Let’s ground this in something every human understands: time.

- 100,000 seconds ≈ 1.16 days

- 1,000,000 seconds ≈ 11.57 days

- 1,000,000,000 seconds (1 billion) ≈ 31.7 years

- 1,000,000,000,000 seconds (1 trillion) ≈ 31,700 years

21,000,000 seconds is about 243 days. #bitcoin

— LNbitcoin (@lnbitcoin) January 22, 2026

If Time is Money, then Money is Time. This puts in prospective how valuable bitcoin is vs fiat.

The US is nearing 39 Trillion in debt.

Now compare that to this:

- 21,000,000 seconds ≈ 243 days

That’s it. Less than a year.

Bitcoin’s entire supply, expressed in time, fits inside a human calendar.

Now apply the same lens to money.

Fiat Debt Exists Outside Human Time

The United States is nearing $39 trillion in debt.

Thirty-nine trillion.

If that debt were measured in seconds, you wouldn’t be talking about decades or centuries. You’d be talking about civilizations rising and falling multiple times. Entire recorded human history is roughly 5,000 years. One trillion seconds is 31,700 years.

And fiat money doesn’t stop there.

Depending on how you measure it:

- Physical cash is in the single-digit trillions

- Broad money is tens of trillions

- Total financial assets stretch into the hundreds of trillions

- Derivatives explode the number into figures so large they lose meaning entirely

This isn’t just inflation. This is scale collapse.

At some point, money stops representing stored human effort and starts representing future promises stacked on top of future promises. Debt built on debt, denominated in a unit that can be created without limit.

That’s not money. That’s time theft.

The amount of money in the world depends on how you define it, but it ranges from about $8 trillion in physical cash (M0) to over $80 trillion in broader measures (M2/M3) including digital money, and even hundreds of trillions when including financial assets like stocks and derivatives, with figures like $80 trillion often cited for "broad money" and over $200 trillion for global assets.

Gold alone is worth roughly $16 trillion globally. This Represents ~500,000 years of human-scale time.

Now compare:

- Bitcoin (21M) → ~243 days

- Gold ($16T) → ~507,000 years

- US Debt ($39T) → ~1.24 million years

- Global Assets ($200T) → 6.34 million years

Bitcoin is emerging as the global store of value because it compresses human time into a finite, incorruptible monetary system that cannot be diluted, manipulated, or outgrown.

By anchoring value to a finite, rule-based system instead of arbitrary issuance, Bitcoin restores fairness by ensuring no individual, institution, or nation can steal time and purchasing power from the rest of the world.

Strategy has acquired 22,305 BTC for ~$2.13 billion at ~$95,284 per bitcoin. As of 1/19/2026, we hodl 709,715 $BTC acquired for ~$53.92 billion at ~$75,979 per bitcoin. $MSTR $STRC https://t.co/pJM0Yuy32w

— Michael Saylor (@saylor) January 20, 2026

Michael Saylor understands this.

Money Is Stored Time

Every dollar, at its core, is supposed to represent:

- Hours worked

- Energy expended

- Resources extracted

- Decisions delayed

In other words: money is stored human time.

When new money is created, it doesn’t create new past labor. It dilutes existing stored time. It silently steals purchasing power from everyone holding it and hands it to the issuer first.

This is why fiat inflation feels invisible but brutal.

You don’t notice it day to day.

You notice it over years of your life.

Your time is worth less.

NEW: Morgan Stanley becoming the first major bank to launch its own Bitcoin ETF is a “huge endorsement,” according to CNBC 🟧

— Bitcoin Archive (@BitcoinArchive) January 7, 2026

Michael Saylor said major banks would adopt Bitcoin in 2026.

Here we go 🔥 pic.twitter.com/xpZF9sg9sB

Banks understand this.

Bitcoin Is Time Made Finite

Bitcoin does something radically simple, and radically human.

It caps time.

- 21 million coins

- No shortcuts

- No emergency printing

- No future committee vote

- No “just this once”

In time terms, Bitcoin’s supply is measurable, graspable, and finite. It fits inside a human lifespan. It fits inside a calendar. It fits inside a mental model the brain can actually understand.

Bitcoin isn’t a trade.

— Samson Mow (@Excellion) January 20, 2026

Bitcoin is the trade.

Of your lifetime.

And for generations to come.

Samson Mow understands this.

That’s why Bitcoin feels different.

Not because it’s digital.

Not because it’s new.

Not because it’s volatile.

But because it restores proportionality between value and time.

Why Bitcoin Feels “Expensive”

People say:

“Bitcoin is too expensive now.”

What they mean is:

“I’m anchoring to a fiat unit that is collapsing in time value.”

Bitcoin isn’t getting more expensive.

Fiat is getting cheaper, measured in human life.

Every time new money is created, it pushes claims on the future further out in time. Bitcoin refuses to participate in that lie. It forces value back into a container the human mind can understand.

HISTORY: INSTITUTIONAL TREASURIES NOW HODL 3,000,000 #BITCOIN WORTH $317 BILLION

— The Bitcoin Historian (@pete_rizzo_) January 21, 2025

14% OF ALL BTC THAT WILL EVER BE 🔥 pic.twitter.com/VKVkfM4wLV

Institutions understand this.

The Real Scarcity Is Time

You can print dollars.

You can issue bonds.

You can roll debt forever.

You cannot print seconds.

You cannot dilute your lifespan.

You cannot negotiate with time.

Bitcoin doesn’t promise returns.

It doesn’t promise stability.

It doesn’t promise comfort.

It promises one thing:

The rules won’t change.

Governments are becoming major Bitcoin holders. The US leads with seized BTC, followed by China and the UK.

— Cryptic (@Cryptic_Web3) January 10, 2026

While El Salvador and Bhutan are accumulating Bitcoin through policy and mining, showing its growing sovereign role. pic.twitter.com/A2bbojS55D

Governments understand this.

In a world where money stretches beyond human comprehension, where debt lives longer than civilizations, Bitcoin anchors value back to something real.

Finite supply. Finite time. Human scale.

And once you see money through the lens of time, you can’t unsee it.