Governments Can’t Stop the Hardest Money Ever Created

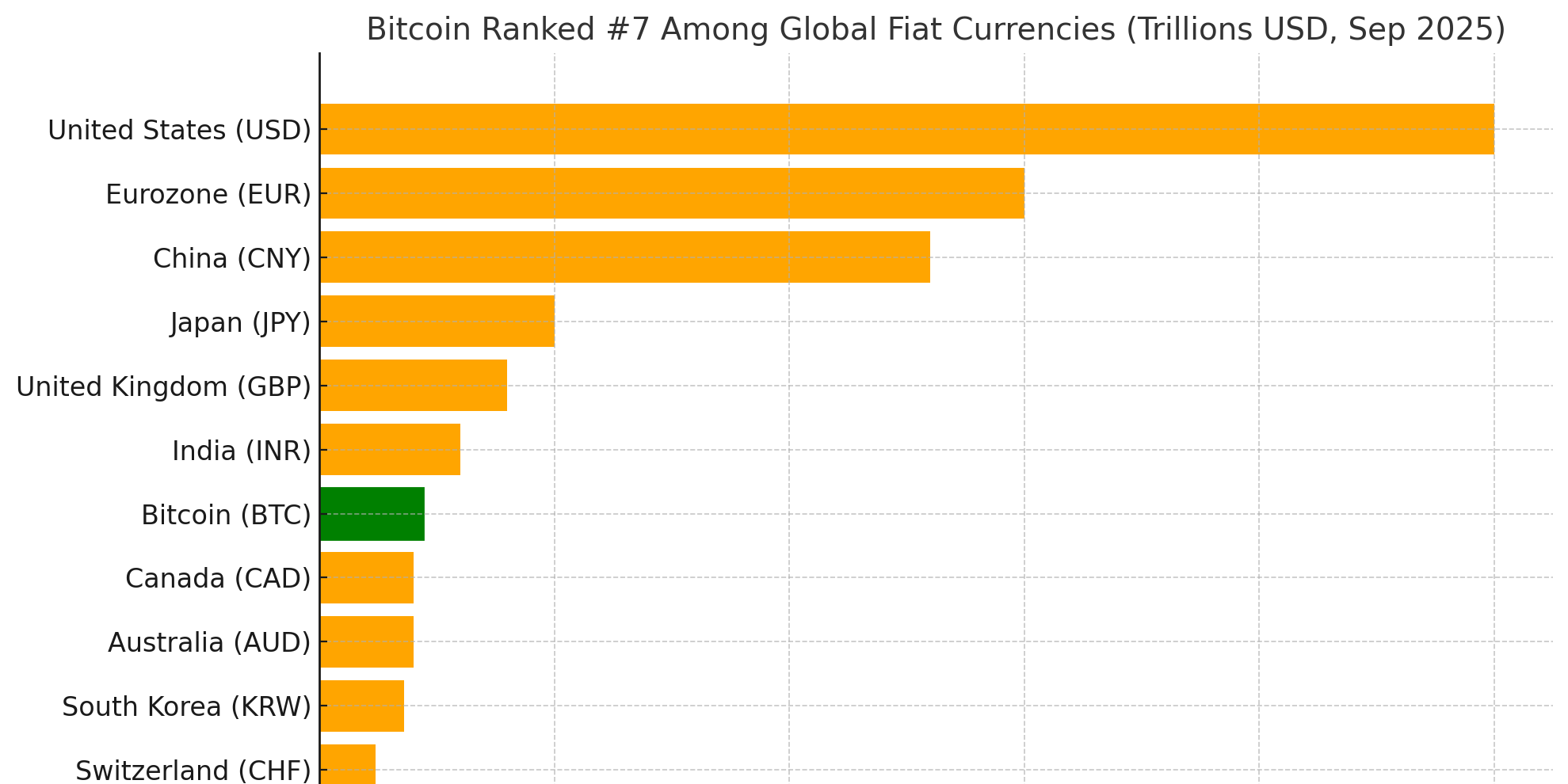

With a market capitalization of approximately $2.22 trillion, and just 15 years old Bitcoin ranks as the 7th-largest currency globally—slipping in right above the Canadian Dollar.

Introduction: The Unstoppable Shift

Bitcoin isn’t here to play nice with governments or central banks. It was built to outlast them. For the first time in human history, money exists that cannot be printed, confiscated, or devalued by political agendas. Governments can delay, regulate, and try to slow it down, but they cannot stop it. Bitcoin’s independence from state control is its true purpose—and the world’s monetary system is already colliding with that reality.

A Borderless Monetary Network

Bitcoin doesn’t respect borders, laws, or capital controls. It runs on over 40,000 nodes worldwide, immune to shutdown. With nothing more than a phone and an internet connection, people can move value across the globe instantly, bypassing banks and governments. From Argentina to Lebanon to the U.S., Bitcoin offers the same rules for everyone: open access, fixed supply, and no permission required.

Governments Can’t Win the Money-Printing Game

Every government in history has tried to print its way out of debt. Every fiat currency has either collapsed or been inflated into worthlessness. The U.S. dollar has lost over 85% of its purchasing power since the gold standard ended in 1971. Trillions are being created at will, diluting the value of savings, wages, and pensions. Bitcoin’s code doesn’t bend to this manipulation. With a supply capped at 21 million coins, it’s mathematically impossible to debase. That makes it the hardest money ever seen. And in monetary history, the hardest money always wins.

Infinity Divided by 21 Million

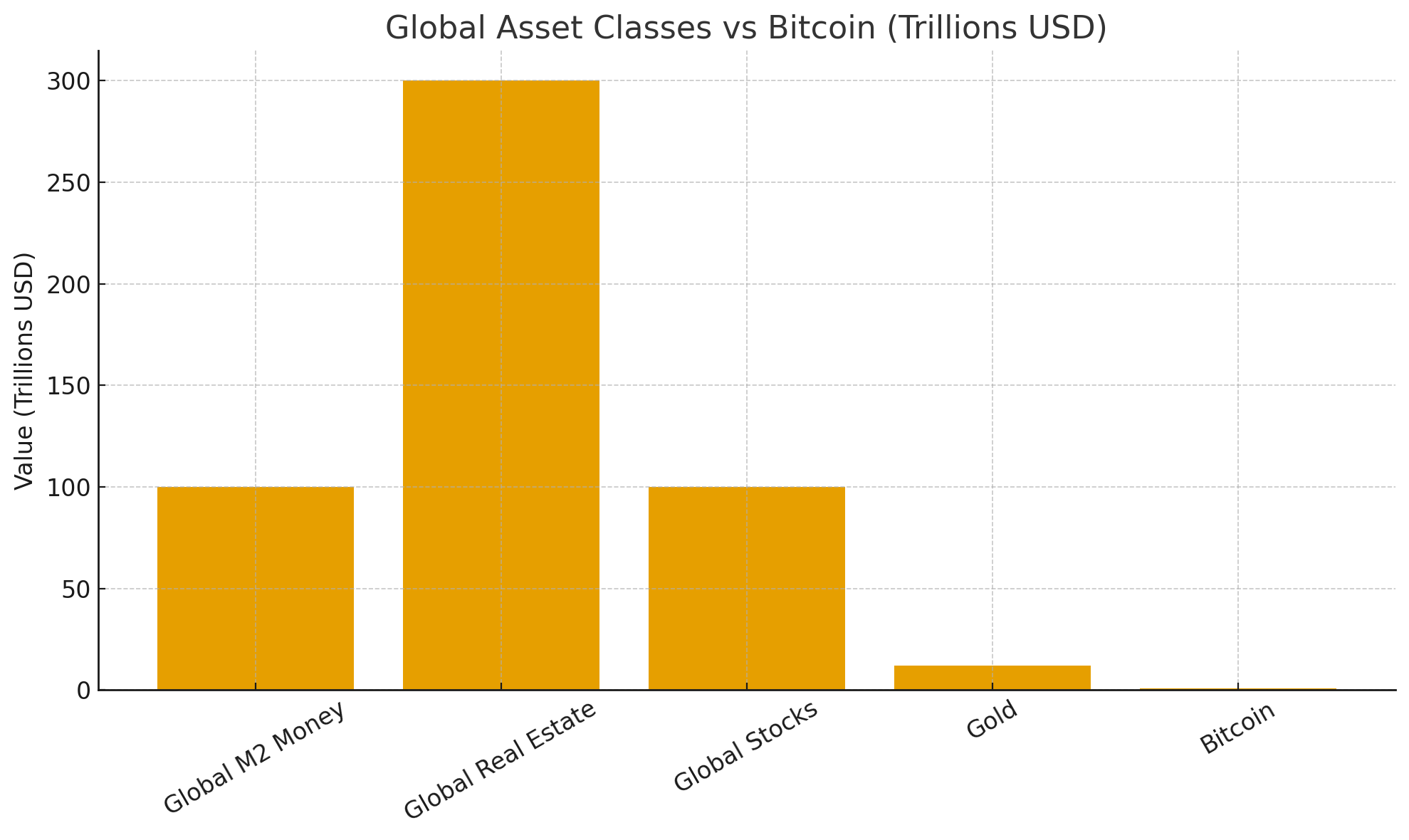

Here’s the reality: everything else is infinite compared to Bitcoin. Global M2 money supply is over $100 trillion. Global real estate sits around $300 trillion. Stocks and equities are worth another $100 trillion. Gold is valued at about $12 trillion. That’s over $500 trillion in assets—measured against Bitcoin’s 21 million fixed coins. Divide infinity by 21 million, and the result is explosive. Every dollar, every house, every share of stock is being silently repriced against Bitcoin. Governments know it. That’s why they try to suppress Bitcoin’s price while quietly positioning themselves for the inevitable.

Built to Resist Control

Banks can be shut down. Accounts can be frozen. Wires can be blocked. But Bitcoin continues, unstoppable. Proof-of-work, pioneered from Adam Back’s Hashcash, makes attacking the network prohibitively expensive. Even if one nation bans it, the network routes around the block. Bitcoin travels over satellites, mesh networks, and encrypted channels. Private keys can’t be confiscated if they’re secured properly. After 15 years of nonstop uptime, Bitcoin has survived every government attack and every prediction of its death.

The Lightning Explosion

Bitcoin’s base layer processes seven transactions per second—not because it’s weak, but because it prioritizes decentralization and security. For scale, the Lightning Network now enables millions of instant, near-free transactions globally. That means Bitcoin can handle both billion-dollar settlements and tiny micropayments, without ever handing control back to governments or banks.

Economic Liberation in Real Time

People trapped in broken monetary systems don’t need theories—they need survival tools. Venezuelans preserve savings in Bitcoin to escape hyperinflation. Nigerians use it to bypass capital controls. Lebanese citizens use it when banks refuse withdrawals. For billions, Bitcoin isn’t speculation. It’s economic freedom today. And as fiat systems unravel further, that demand will multiply exponentially.

Governments Delaying the Inevitable

Let’s be clear: governments aren’t blind to this. They understand Bitcoin threatens their monopoly over money. That’s why they spread fear, drag out regulations, and attempt to suppress its price. They need time to build reserves and adjust to a system they cannot control. But suppression only delays the explosion. Eventually, supply shock collides with demand. And when it does, the repricing will be violent.

Satoshi’s Untouchable Design

Satoshi Nakamoto disappeared, leaving no leader for governments to pressure, no company to regulate, no office to raid. Bitcoin is ownerless and leaderless, defended by code and volunteers worldwide. This is its genius. It cannot be corrupted from the top down. Every attempt to fight it has only strengthened its resilience.

The Hardest Asset Wins

History is clear: the hardest form of money outcompetes weaker alternatives. Gold outlasted silver. Fiat displaced gold only by force. But Bitcoin is harder than both. It’s portable, divisible, verifiable, and finite. When measured against $500 trillion of global assets, Bitcoin at today’s prices is still microscopic. The upside isn’t speculation—it’s math.

Global Asset Classes vs Bitcoin

This makes the “infinity ÷ 21 million” point visually obvious—Bitcoin’s current market cap is still only a tiny sliver compared to money supply, real estate, stocks, and gold. We are still early, but its happening as Bitcoin is currently a 2.2 Trillion Dollar Asset.

Current U.S. Debt Snapshot

- Total U.S. national debt: Approximately $36.9 trillion as of July 2025 USAFacts.

- Recent pace: The U.S. is now adding roughly $1 trillion every five months—more than double the rate from previous decades

If Bitcoin Were a Fiat Currency

- With a price of ~$111,000 and a market capitalization of approximately $2.22 trillion, Bitcoin would rank as the 7th-largest currency globally—slipping in right above the Canadian Dollar.

- United States Dollar (USD) – ~$25T

- Eurozone Euro (EUR) – ~$15T

- Chinese Yuan (CNY) – ~$13T

- Japanese Yen (JPY) – ~$5T

- British Pound (GBP) – ~$4T

- Indian Rupee (INR) – ~$3T

- Bitcoin (BTC) – ~$2.2T

- Canadian Dollar (CAD) – ~$2T

- Australian Dollar (AUD) – ~$2T

If Bitcoin Were a Public Company

| Metric | Value |

|---|---|

| Market Cap | ~$2.22 trillion |

| Rank | 8th largest company in the world |

Top 10 Companies by Market Capitalization as of Early September 2025

Based on multiple sources:

- NVIDIA – ~$4.17 trillion

- Microsoft – ~$3.77 trillion

- Apple – ~$3.56 trillion

- Alphabet (Google) – ~$2.76 trillion

- Amazon – ~$2.48 trillion

- Bitcoin – ~$2.2 trillion

- Meta Platforms – ~$1.89 trillion

- Tesla – ~$1.12 trillion

- Berkshire Hathaway – ~$1.08 trillion

Its current market capitalization would place it among the top eight asset-holders globally, in the same league as corporate behemoths. Treat it as a company, or major government currency and it’s already playing in the big leagues.

Remember Bitcoin’s Purpose

This isn’t about short-term price moves. This is about the endgame for money. Governments are trying to slow Bitcoin down so they can catch up. But they can’t change the math. They can’t print Bitcoin. They can’t stop Bitcoin. The world’s wealth is being repriced against 21 million coins, and sooner or later, the dam will break.

Bitcoin is coming for everything—real estate, stocks, gold, and every fiat currency on Earth. With a fixed supply of just 21 million, every dollar, every property, every share, and every ounce of wealth is being silently repriced against Bitcoin as shown above. Most people are still unaware of how massive Bitcoin has already become, but this is just the beginning. Governments can stall, banks can resist, but the math is already written: the hardest money always wins, and Bitcoin is about to swallow the value of the world.