M2 Money Supply, U.S. Economic Instability, and the Path to Reserve Status

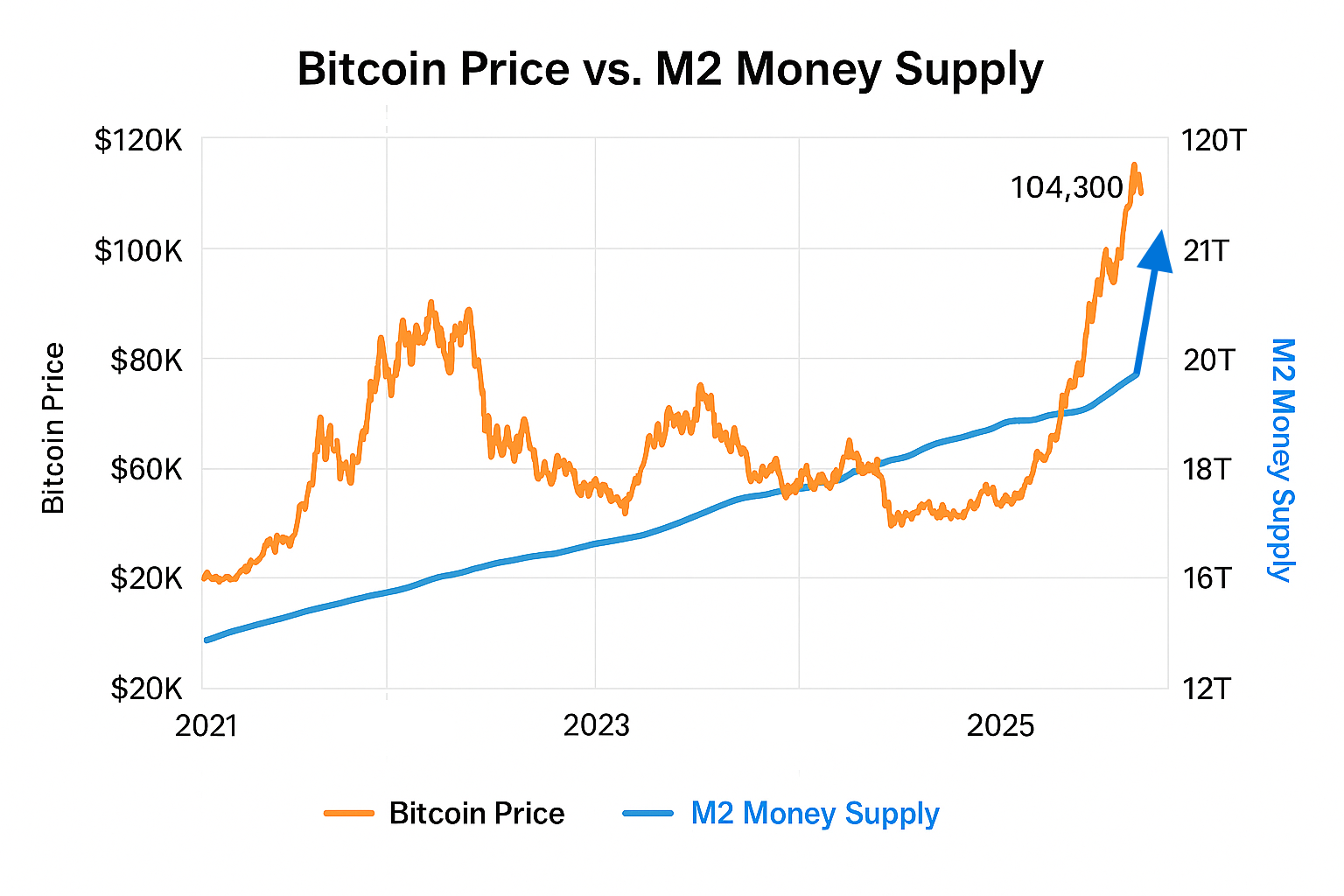

If you want to know where Bitcoin is headed, simply follow the M2 money supply. And right now, according to the latest M2 data, global liquidity isn’t just rising — it’s exploding.

As of May 19, 2025, Bitcoin (BTC) is trading near $104,370, edging closer to its all-time high of $109,114 set earlier this year. While such price surges are nothing new to seasoned market watchers, the underlying forces propelling this rally are profoundly rooted in global macroeconomic shifts. Top among them is the correlation between Bitcoin and the M2 money supply, a broad measure of money in circulation, along with mounting instability in U.S. fiscal policy and monetary strategy.

The M2 Money Supply: Bitcoin’s Invisible Anchor

A growing body of evidence shows a strong correlation between Bitcoin's price movements and global M2 money supply trends. The M2 metric includes cash, checking deposits, and easily convertible near money like savings deposits and money market securities. Analysts have found a high correlation between Bitcoin and M2 over the past decade, indicating a striking relationship.

According to a widely circulated analysis published, Bitcoin tends to follow the direction of M2 with a delay of approximately 70 to 105 days. This time-lag correlation has been used by macro-focused Bitcoin investors to anticipate major market moves. When M2 expands, liquidity rises, traditionally inflating the price of both traditional and digital assets. With central banks around the world, particularly the Federal Reserve, flooding the market with liquidity through continued Treasury purchases, the foundation for another Bitcoin surge is being laid.

A key insight emphasizes that Bitcoin's price movements do not simply react to nominal M2 values but rather to the rate of change in M2. Recent months have seen M2 increasing at a pace not observed since early 2020, creating ideal conditions for Bitcoin's price expansion.

U.S. Credit Downgrade and Federal Reserve Intervention

Adding fuel to Bitcoin's rally is growing concern over the fiscal integrity of the United States. On May 16, 2025, Moody’s downgraded the U.S. sovereign credit rating from Aaa to Aa1, citing unsustainable debt levels, legislative gridlock, and fiscal irresponsibility as key drivers. This downgrade marks a pivotal moment, shaking confidence in U.S. Treasury bonds, long considered the world’s safest asset.

In response to increasing bond yields and diminished investor appetite, the Federal Reserve has resumed large-scale purchases of U.S. Treasuries, a form of quantitative easing. This decision, while stabilizing in the short term, introduces more dollars into the economy, exacerbating inflation risks and weakening the dollar's purchasing power. Bitcoin, with its fixed supply and decentralized architecture, stands as a natural hedge against these forces.

China's Strategic Exit from U.S. Debt

Perhaps one of the most seismic developments in the global financial landscape is China’s quiet but strategic reduction in U.S. Treasury holdings. In early 2025, China offloaded approximately $18.9 billion in U.S. Treasuries, reducing its exposure to American debt to a multi-decade low. The scale and symbolism of this move are profound.

This divestment reflects China’s broader de-dollarization campaign aimed at reducing reliance on the U.S. financial system amidst escalating geopolitical tensions. With other BRICS nations exploring alternative trade settlement systems and central bank digital currencies (CBDCs), Bitcoin’s apolitical, borderless nature makes it an increasingly attractive candidate for global reserve diversification.

Bitcoin's Emergence as a Strategic Reserve Asset

The debate around Bitcoin becoming a reserve asset has moved from fringe theory to serious consideration in policymaking circles. In March 2025, President Donald Trump signed an executive order establishing a Strategic Bitcoin Reserve. This move aims to build a government-controlled cache of BTC as a hedge against future monetary instability and to ensure the U.S. remains competitive in the digital asset era.

Institutional adoption has accelerated in parallel. Sovereign wealth funds, pension funds, and even central banks in developing nations have begun allocating a small percentage of their reserves to Bitcoin. Unlike gold, Bitcoin is easily transferable, divisible, and verifiable—traits that align with modern financial infrastructure and cross-border commerce.

A Perfect Storm for Bitcoin

When we combine the data—rising M2, falling confidence in fiat currency, geopolitical decoupling from the U.S. dollar, and the embrace of Bitcoin by governments and institutions alike—a compelling narrative emerges. Bitcoin is no longer just a speculative asset or a tool for the tech-savvy. It is positioning itself as a central pillar in the future of global finance.

Conclusion

The pieces are falling into place. As M2 surges and confidence in traditional fiscal instruments wanes, Bitcoin stands at the precipice of a historic transition. What was once considered a radical experiment in digital value could very well become the next global reserve currency. Investors, policymakers, and the public at large would do well to pay attention.

If you want to know where Bitcoin is headed long-term, simply follow the M2 money supply. And right now, according to the latest M2 data, global liquidity isn’t just rising — it’s exploding.