Gold vs. Bitcoin vs. Silver: Why Bitcoin Is the Superior Long, Term Store of Value and Money

Gold and silver preserved value in the past, but Bitcoin is optimized for a digital world. With fixed supply, instant global transfer, easy verification, and rapid adoption, Bitcoin combines the strengths of sound money with far greater long-term upside.

For thousands of years, humanity has searched for reliable money, something durable, scarce, portable, divisible, and resistant to manipulation. Gold and silver served this role for centuries. Fiat currencies replaced them, then steadily failed. Bitcoin now enters the picture as a radically new monetary asset: digital, finite, global, and trust-minimized.

When comparing gold, silver, and bitcoin, the question isn’t which came first, but which works best in a digital, global economy.

What Makes Good Money?

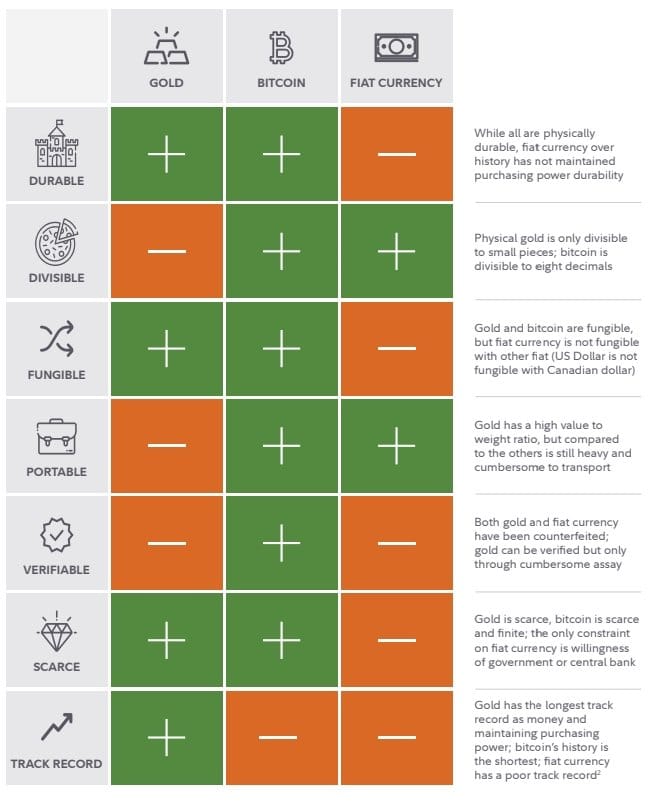

Sound money has consistent properties across history:

- Durable - doesn’t decay or degrade

- Divisible - usable at any scale

- Fungible - interchangeable units

- Portable - easy to move and store

- Verifiable - authenticity easily proven

- Scarce - supply is limited and predictable

- Track Record - trusted across time

The above image highlights these exact traits, and when evaluated honestly, Bitcoin increasingly dominates.

Gold vs. Bitcoin

Durability

Gold is physically durable, but fiat currencies lose purchasing power over time. Bitcoin, while digital, is information, replicated globally across tens of thousands of nodes. As long as the internet exists, Bitcoin exists.

Winner: Bitcoin (durable purchasing power)

Divisibility

Gold is difficult to divide without melting or assaying. Bitcoin is divisible into 100 million units per coin (satoshis), perfect for both micro-transactions and global settlement.

Winner: Bitcoin

Fungibility

Gold and bitcoin are fungible assets. Fiat currencies are not (USD ≠ CAD ≠ MXN).

Winner: Tie (Gold & Bitcoin)

Portability

Gold is heavy, expensive to secure, and difficult to transport across borders. Bitcoin moves globally in minutes, secured by cryptography, without permission.

Winner: Bitcoin (by orders of magnitude)

Verifiability

Gold must be assayed, weighed, and tested. Counterfeits exist. Bitcoin can be verified instantly by running a node, no trust required.

Winner: Bitcoin

Scarcity

Gold is scarce, but its true supply is unknown. New mining technology and off-planet extraction could expand supply. Bitcoin is provably finite, 21 million coins, no exceptions.

Winner: Bitcoin

Track Record

Gold has thousands of years of history as money. Bitcoin is young, but its adoption curve is faster than any monetary technology in history.

Gold’s strength is history. Bitcoin’s strength is trajectory.

Winner: Gold (for now)

Silver vs. Bitcoin

Silver is often called “poor man’s gold,” but it has significant drawbacks:

Industrial Demand

Most silver demand is industrial, not monetary. This creates price suppression, volatility, and dependency on economic cycles.

Bulk & Storage

Silver is heavy and bulky. Storing meaningful value requires space, insurance, and logistics.

Supply Expansion

Silver supply expands with industrial mining demand. There is no hard cap.

Bitcoin vs Silver Verdict:

Bitcoin is more scarce, more portable, more verifiable, and more monetary than silver.

Bitcoin’s Biggest Advantage: Asymmetric Upside

Gold and silver are mature markets. Bitcoin is not.

- Gold market: ~$15–16 trillion

- Silver market: ~$1.5 trillion

- Bitcoin market: still absorbing global adoption

Bitcoin doesn’t just compete with gold, it competes with:

- Global savings

- Bonds

- Real estate as a store of value

- Fiat monetary systems

Bitcoin vs Gold vs Silver.

— DEECRYPT🦉 (@deecypt) January 24, 2026

Big difference. pic.twitter.com/mdTSZLqUQH

Bitcoin vs Gold & Silver

Bitcoin is still early in its monetization phase, while gold and silver are fully monetized.

“Bitcoin Is Young”, And That’s the Point

Yes, Bitcoin is young.

But:

- Internet adoption took decades

- Smartphones took a decade

- Social networks took years

- Bitcoin adoption is happening faster than all of them

Bitcoin is:

- Held by governments

- Custodied by institutions

- Traded via ETFs

- Used by individuals worldwide

- Integrated into payment rails

- Adopted in emerging markets as survival money

🇺🇸 Florida just introduced a bill to create a Strategic Bitcoin Reserve to covert 10% of state funds to Bitcoin pic.twitter.com/LwSy00iBhd

— Trending Bitcoin (@TrendingBitcoin) January 23, 2026

Florida is just the latest state to introduce a Bitcoin Strategic Bitcoin Reserve bill along with Arizona (passed), New Hampshire (passed), Texas (passed), Alabama, Georgia, Illinois, Iowa, Kansas, Kentucky, Maryland, Massachusetts, Michigan, Missouri, New Mexico, North Carolina, Ohio, Oklahoma, Rhode Island, West Virginia, and Utah. Along with some introduced but so far failed bills in: Montana, North Dakota, Pennsylvania, South Dakota, Wyoming.

Youth is not a weakness, it’s upside.

Final Verdict

| Asset | Best Use |

|---|---|

| Gold: | Historical store of value |

| Silver: | Industrial metal with monetary history |

| Bitcoin: | Digital, global, finite money |

Gold preserved wealth.

Silver facilitated trade.

Bitcoin does both—globally, digitally, and without trust.

Bitcoin is not replacing gold because gold failed.

Bitcoin is replacing gold because technology improved money.

| Property | Bitcoin | Gold | Silver |

|---|---|---|---|

| Durability | ✔ Digital, cannot decay | ✔ Physically durable | ✔ Physically durable |

| Divisibility | ✔ 100M sats per BTC | ✖ Limited, impractical | ✖ Limited, impractical |

| Fungibility | ✔ Fully fungible | ✔ Fungible | ✔ Fungible |

| Portability | ✔ Global, instant | ✖ Heavy, costly | ✖ Very heavy, bulky |

| Verifiability | ✔ Instant, trustless | ✖ Requires assay | ✖ Requires assay |

| Scarcity | ✔ Fixed at 21M | ✔ Scarce, unknown supply | ✖ Expands with mining |

| Supply Control | ✔ Algorithmic, immutable | ✖ Mining & discovery | ✖ Mining-driven |

| Censorship Resistance | ✔ Very high | ✖ Low | ✖ Low |

| Storage Cost | ✔ Near zero | ✖ High | ✖ High |

| Track Record | ◑ Short but fast adoption | ✔ Thousands of years | ✔ Thousands of years |

| Upside Potential | ✔✔ Very high | ◑ Limited | ◑ Limited |